Flanges Market

Raw materials used in the manufacturing of flanges include stainless steel, carbon steel, and alloy steel. The selection of these raw materials is critical to ensuring the durability and performance of the final products, given the challenging conditions in offshore environments. A few key raw material suppliers in the flanges industry are ArcelorMittal, ASA Alloys Inc., Belmont Metals Inc., Metal Alloys Corporation, Nippon Steel and Sumitomo Metal Corporation, Hebei Iron and Steel Group, Baosteel, POSCO, and Shangshang Desheng Group, among others.

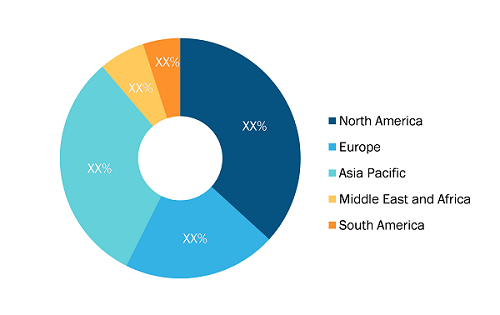

The scope of the global flanges market report focuses on type, material, industry, and region. Based on type, the flanges market is segmented into weld neck, slip-on, socket weld, lap joint, blind, and others. In terms of material, the market is classified into stainless steel, carbon steel, alloy steel, and others. Based on industry, the market is categorized into oil & gas, chemical & petrochemical, power generation, manufacturing, water management, food & beverages, and others. Based on geography, the flanges market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The Asia Pacific flanges market is segmented into China, India, South Korea, Australia, and the Rest of Asia Pacific. Asia Pacific accounted for the largest share of the flanges market owing to the presence of a large population and the increased demand from the oil & gas and food & beverages industries across China, India, and Japan. The food & beverages industry in Asia Pacific is expected to record an annual growth rate of 9–10% between 2021 and 2024. The increase in government initiatives for water-related infrastructure drives flanges market growth. According to the International Trade Administration (ITA), in January 2021, there were ~10,000 water treatment plants in China for wastewater in municipalities and rural areas. The rise in demand for water and wastewater treatment drives the global flanges market.

China is a major oil and gas producer in Asia Pacific. The country is also considering the construction of new offshore oil and gas rigs across different locations. In May 2023, China announced the completion of a new 12,000-ton offshore drilling rig construction. By supporting such projects, the country is pushing its offshore drilling activities to lower the dependency on imports of oil and gas products. In June 2023, China announced its intentions to drill deeper into offshore platforms, irrespective of its possible repercussions on its relations with the US. The US has also announced the ban on Chinese oil and gas rig companies. Moreover, China has discovered some new sources of offshore oil and gas in the South China Sea, and the company CNOOC has announced its interest in deploying some of the vessels for the construction of new offshore drilling rigs in the coming years. Such progress in offshore oil and gas projects triggers the demand for flanges across China, which, in turn, drives the flanges market growth.

Flanges Market Analysis: Material Overview

Based on material, the flanges market share is divided into stainless steel, carbon steel, alloy steel, and others. The alloy steel segment held the largest flanges market share in 2023. Flanges can be made from a variety of materials, such as alloy steel, cast iron, carbon steel, and stainless steel. These flanges are used to connect pipe sections and piping components to form a fluid distribution piping system. Stainless steel flanges are generally used in piping systems, where the flanges should offer certain benefits such as corrosion resistance, prevent contamination, and are resistant to extreme temperatures. In general, pipes and flanges made of stainless steel are more durable than those made from carbon steel, resulting in more demanding applications across the oil & gas industry. Stainless steel flanges are used in oil and gas refineries, power plants, chemical plants, paper mills, and food and beverage processing facilities.

Stainless steel flanges are used in applications in oil & gas, food & beverages, and water treatment industries where corrosion resistance requirement is high, contamination prevention, high temperatures applications. Flanges made from stainless steel are highly durable; however, they are more expensive than regular carbon steel. Stainless steel flange products are mainly used in highly corrosive oil and gas applications. Globally, the demand for stainless steel flanges is driven primarily by the rising investment in refining operations across the oil & gas industry. Also, developments in the pharmaceutical, chemical, marine, water treatment, agricultural, and construction industries drive the market for this segment.

The oil & gas industry drives the demand for stainless steel flanges in the US. During 2020–2021, consumption of stainless steel flanges in the US fell, owing to the COVID-19 pandemic. The demand for stainless-steel flanges increased in 2022 as energy prices stabilized after the pandemic. According to the International Energy Forum Organization, the global upstream oil and gas capital expenditures reached US$ 499 billion in 2022, an increase of 39% compared to 2021. Growth in oil and gas expenditure across the globe drives the demand for stainless-steel flanges.

Flanges Market: Competitive Landscape and Key Developments

AFG Holdings, Inc.; Armetal Stainless Pipe; Coastal Flange, Inc.; Flanschenwerk Bebitz GmbH; General Flange and Forge LLC; Mass Global Group; METALFAR Prodotti Industrial SpA; Proflange; Sandvik AB; and Texas Flange are among the key players covered in the flanges market report. Companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.