Self Erecting Tower Cranes Market

Growing Construction Activities Across Globe Drive Self Erecting Tower Cranes Market Growth

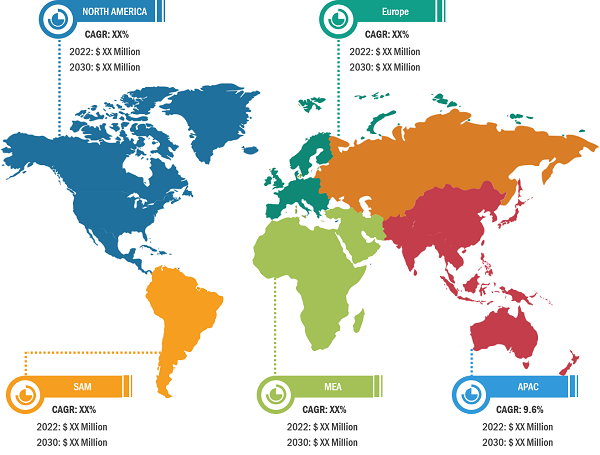

In Asia Pacific, demand for self-erecting cranes is rising significantly owing to rapidly growing construction activities. As per the data published by the government agency in 2023, Malaysia’s construction sector soared by ~9.6% to reach US$ 7.15 billion in Q3 of 2023. Apart from Asia, the construction sector in Europe plays an important role in its overall economy. The European economy relies heavily on the construction sector. With over 3 million businesses, the sector accounts for around 9% of the European Union’s (EU) GDP. In 2021, the European Union (EU) invested 5.6% of its GDP in housing. This percentage varied throughout the member states, ranging from 7.6% in Cyprus, 7.2% in Germany, 2.1% in Ireland, and 2.2% in Latvia to 2.3% in Poland. In January 2024, the European Climate, Environment, and Infrastructure Executive Agency received ∼ 400 applications requesting US$ 20 billion for transport infrastructure projects. The rising population propels the demand for public infrastructure and the development of new transport networks and residential structures. As per the data published by the European Union in 2023, the EU’s population increased from 446.7 million in January 2022 to 448.4 million in January 2023. In 2021, various construction projects were commenced that included A303/A30/A358 Road Corridor Improvement, E39 Herdal-Royskar Motorway, Nizhnekamsk-Naberezhnye Chelny Bypass, Banja Luka-Prijedor-Novi Grad Motorway, and Llogara Tunnel. According to the European Commission, in June 2022, the European Union planned to invest US$ 5.0 billion in sustainable, safe, and efficient transport infrastructure. The increasing investments by governments of countries in Europe in infrastructure and industrial development contribute to the self erecting tower cranes market growth.

The scope of the self erecting tower cranes market report focuses on North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

In terms of revenue, Europe accounted for largest share of the global self erecting tower cranes market share in 2023. North America is the second-largest contributor to the global market, followed by Asia Pacific. The demand for these cranes in Europe is mainly driven by the high demand for residential construction and the presence of key players. Potain self-erecting cranes are considered the most popular in Europe; thus, it holds the largest market share in the region. Schulthess Holzbau, a Switzerland-based building contractor, hired the Potain Hup M 28-22 self-erecting crane for its schoolhouse conversion project in rural Reisiswil, Bern, Switzerland. The crane has a capacity of 2.2 tons and a lifting length of 28-meter jib. Further, Germany has one of the notable construction sectors, as the sector accounts for ~ 6% of the total GDP. In 2024, the German government announced an investment of US$ 40 billion for rail projects between 2024 and 2027. The Hauptverband Deutsche Bauindustrie (HDB), a German construction industry association, predicts that the construction industry will contribute significantly to the country’s GDP in the coming years. The expansion of this industry is majorly attributed to the rise in residential and commercial or public infrastructure construction projects. As Germany is one of the popular tourist destinations across the region, there is constant growth in the construction of hotels and malls in the country. With the rising construction of commercial buildings, the demand for self-erecting cranes is increasing.

The self-erecting cranes market in Asia Pacific is growing rapidly owing to increasing investments in residential construction projects and growing infrastructure development projects. In Asia Pacific, the construction sector in India is growing at a rapid pace owing to the wide presence of a huge population and rapid urbanization. India’s construction sector was valued at ~ US$ 701.7 billion and is projected to reach US$ 1.4 trillion by 2025. Further, China holds the largest self-erecting crane market share in 2022; this is owing to the presence of several local crane manufacturers. A few of the local Chinese crane manufacturers include Xuzhou Heavy Machinery Co., Ltd (XCMG); SANY Heavy Equipment Co., Ltd; Zenhua Heavy Industries Co., Ltd (ZPMC); and Zoomlion. The presence of key players and the growing construction sector across India and other Asia Pacific countries, such as Malaysia, Singapore, Thailand, and Vietnam, drives the self-erecting crane market in the region.

Self Erecting Tower Cranes Market Analysis: Application Overview

Based on application, the self erecting tower cranes market is segmented into residential construction, commercial construction, and others. The residential construction segment dominated the market in 2023. Self-erecting cranes are widely used in the construction of small residential buildings. Several construction companies and contractors are using these cranes to increase operational efficiency. In April 2021, Fager Framing Inc., a US-based contractor, used a Potain self-erecting crane located in Iowa, US. It uses Potain Igo T 85 A to erect the structure for large residential buildings. According to Manitowoc, Inc., crane drives productivity and simplifies onsite operations. According to the India Brand Equity Foundation Organization, in 2022, the residential sector in India was valued at around US$ 180 billion, which is 7% of the country’s GDP. According to the Oxford Economics Report, in 2023, the US, China, and India invested almost US$ 2.4 trillion in the construction industry. Thus, increasing urbanization and rising construction activities in the residential sector, especially in developing countries, propel the global self-erecting crane market growth for the residential construction segment.

Self Erecting Tower Cranes Market: Competitive Landscape and Key Developments

Liebherr International AG, The Manitowoc Co Inc., Terex Corp., FMGru S.r.l, Gruas Saez S.L, Gru Dalbe srl, Tavol Cranes Group. Co. Ltd., Dawson Group Ltd., P&J Arcomet, and Action Construction Equipment Limited are among the key players covered in the self erecting tower cranes market report. The market report includes growth prospects, future markettrends, and their foreseeable impact during the forecast period.

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the self erecting tower cranes market. The market initiative is a strategy adopted by companies to expand their footprint across the world and meet the growing customer demand. The market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.