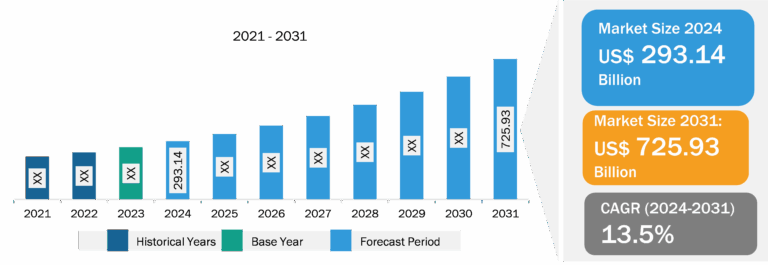

Regtech Market

Rising Need for Faster Transactions Across Globe to Fuel RegTech Market Growth

Blockchain technology has gained massive traction in the financial industry due to its potential to reduce the time taken for interbank transactions and improve operational efficiency. Many financial firms view blockchain as a mechanism to make transactions faster, minimize error rates, and eliminate the need for reconciliation. Blockchain technology is particularly well-suited is the payments space. By leveraging blockchain, financial institutions can bring down multiday settlement cycles to real-time, enhancing transaction operations. This has the potential to improve companies’ capabilities for Anti-Money Laundering (AML), Know Your Customer (KYC), and regulatory compliance data.

The huge adoption of blockchain technology results in faster transactions and settlements, benefiting both financial institutions and their customers. By eliminating the need for intermediaries, such as clearinghouses and custodians, blockchain can streamline the process and reduce costs. This can help banks avoid labor-intensive procedures with their customers and currency exchanges. In addition to speed and efficiency, blockchain technology offers enhanced security and transparency. Transactions recorded on the blockchain network are approved by multiple computers and devices, reducing the potential for human error and ensuring accurate records. The decentralized and immutable nature of blockchain makes it tamper-proof, providing a secure platform for financial transactions. Hence, all the associated benefits are anticipated to offer lucrative opportunities for market growth.

RegTech market: Industry Overview

The global RegTech market is categorized on the basis of component, deployment type, enterprise size, application, industry vertical, and geography. Based on component, the market is divided into solution and services. In terms of deployment type, the market is bifurcated into on-premises and cloud. Based on enterprise size, the market is divided into SMEs and large enterprises. By application, the market is segmented into risk and compliance management, AML and fraud management, and identity management. Based on industry vertical, the market is segmented into banks, insurance, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The Europe RegTech market is segmented into the UK, Germany, France, Italy, Russia, and the Rest of Europe. The UK held a significant RegTech market share in Europe. The adoption of technology in regulatory and compliance efforts in the UK has led to the emergence of new risks, such as cyber threats, fraud, and financial crimes. Presently, there are 25–30% of UK firms which have shown their preparedness to establish processes that align with regulatory guidelines. As a result, RegTech companies are actively exploring creative approaches to implement these systems more effectively and efficiently. Furthermore, in September 2017, the Financial Conduct Authority (FCA) partnered with R3, RBS, and other major banks to develop a prototype application using distributed ledger technology (blockchain) for regulatory reporting of mortgage transactions. This innovative prototype enables the automatic generation of receipts upon mortgage bookings, streamlining the regulatory reporting process.

The UK stands out among nations for its comprehensive set of regulatory reforms, including the Markets in Financial Instruments Directive (MiFID), European Market Infrastructure Regulation (EMIR), BASEL III, and Payment Service Directive (PSD). These regulations have been implemented to enhance liquidity and transparency within the financial system. Considering the uncertainties surrounding Brexit, RegTech companies must adapt their solutions accordingly when implementing RegTech solutions for major financial services firms. This flexibility ensures that the potential impacts and variations resulting from Brexit are effectively addressed and incorporated.

RegTech Market Analysis: Competitive Landscape and Key Developments

The RegTech market report emphasizes the key factors driving the market and prominent players’ developments. IBM Corporation; Deloitte; Thomson Reuters Corporation; PWC; Broadridge Financial Solutions, Inc.; MetricStream Inc.; Jumio; ACTICO GmbH; Acuity Group Limited; and Ascent Technologies are among the prominent players profiled in the RegTech market report. The market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities. As per company press releases, below are a few recent key developments:

- In June 2023, EquiLend, a global securities finance technology firm, and Broadridge Financial Solutions, Inc., a leading global Fintech company, announced a collaboration to enable straight-through processing (STP) for equity securities finance transactions to the National Securities Clearance Corporation’s (NSCC) central counterparty (CCP). This partnership will leverage EquiLend’s liquidity sourcing options and integrate them with Broadridge’s buy-side portfolio and order management solution. The integration will allow clients to trade and automatically submit transactions through Broadridge’s SFT Submission Service, providing a seamless process without significant operational changes. This collaboration aims to provide clients with the benefits of central clearing, including capital cost reduction and risk mitigation, while simplifying their compliance with regulatory requirements.

- In April 2022, PricewaterhouseCoopers Aarata LLC introduced a compliance advisory service utilizing RegTech in collaboration with CUBE, a RegTech firm. This partnership marks the third collaboration between CUBE and the broader PwC global network, having previously worked with PwC UK and PwC Switzerland. The joint effort of PwC Aarata and CUBE aims to introduce a service called Know Your Regulations (KYR) in Japan. This service enables clients to accurately determine the regulations applicable to their businesses across various countries and regions, facilitating a more efficient and thorough understanding of their compliance status.

- In April 2021, Broadridge Financial Solutions, Inc., a prominent global Fintech leader, joined forces with FundApps, a global RegTech provider, to integrate FundApps’ regulatory compliance technology into Broadridge’s buy-side portfolio and order management solution. This integration offers Broadridge’s clients a distinctive regulatory compliance solution that effectively caters to the requirements of asset managers. It addresses various aspects such as shareholder disclosures, sensitive industry monitoring, and position limit reporting, thereby streamlining operations and eliminating operational hurdles.