Aramid Fiber Market

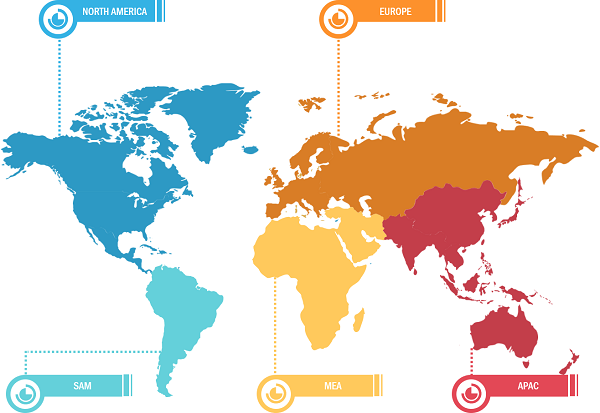

In 2022, Asia Pacific accounted for the largest portion of the global aramid fiber market share. The rapid industrialization and economic growth in Asia Pacific have increased demand for these fibers. The rising demand for cars across the region is majorly driven by the increase in the spending power of consumers, the rising number of double-income families, the expanding working class, and the rapid economic growth of Asian nations. Aramid fiber is increasingly used in the automotive industry due to its attributes and benefits, such as temperature resistance, strength, reinforcement, and other properties that can help improve filters, reinforce tires, powertrain components, turbocharger hoses, brake pads, belts, gaskets, clutches, seat textiles, electronics, seat sensors, and hybrid motor materials. Thus, a well-established automotive sector and a rise in demand for vehicles with advanced features are the factors that are primarily driving the aramid fiber market across the region.

Increasing Demand from End-Use Industries Propels Aramid Fiber Market Growth

Due to their excellent strength-to-weight ratio and heat resistance properties, aramid fibers play an essential role in composite materials and automotive and military applications. They can easily be integrated into textile applications in protective clothing, offer greater protection against heat, flame, and chemical products, and provide maximum comfort and absolute reliability. These fibers are a class of strong synthetic fibers commonly used in ballistic-rated body armor fabrics and composites. This reinforced fiber is lightweight and has a tensile strength five times stronger than the same weight, with high heat resistance and low cutting capacity. High strength-to-weight ratio, exceptional strength and durability, core mechanical properties, thermal and chemical resistance, good abrasion resistance, non-conductive, no melting point, low flammability, and good fabric integrity at elevated temperatures are among the key characteristics of aramid fibers.

Aramid Fiber Market: Segmental Overview

Based on product type, the aramid fiber market is segmented into para-aramid fiber and meta-aramid fiber. The para-aramid fiber segment held the largest share of the market in 2022 and is expected to record the highest CAGR from 2022 to 2030. Para-aramids have high tensile strength (the highest stress that a material can withstand) and modulus behavior (the tendency of a material to deform when force is applied). The dry-jet, wet-spinning method is used to make these fibers, which results in fiber with completely extended liquid crystal chains generated along the fiber axis and a high degree of crystallinity, which boosts the fiber’s strength. Para-aramid fibers can be made with a tenacity of 23g/den and a break elongation of 3.5%.

In comparison with meta-aramid polyamide, fibers manufactured from para-aramid polyamide have a higher strength. Further, para-aramid fibers are stiffer and more robust than meta-aramid fibers. However, they are chemically sensitive, and acids, alkalis, and bleaches weaken the strength of para-aramid polyamide. Examples of para-aramid fibers are Kevlar, Technora, Twaron, and Herron. Furthermore, their increasing use in security and safety applications drives the demand for para-aramid fibers. It is used in protective clothing such as bulletproof vests, helmets, and vehicle armor due to its ultra-high strength and rigid and highly oriented molecular structure. Thus, due to all these factors, the para-aramid fibers segment dominates the aramid fiber market.

Based on the end-use industry, the aramid fiber market is segmented into safety & protection equipment, aerospace, automotive, electronics & telecommunication, and others. The automotive segment held the largest market share in 2022. The automotive industry uses different types of materials, such as iron, aluminum, plastic, steel, and glass, to build cars and other vehicles. Aramid fibers are extensively used as a substitute for fiberglass and steel due to their lightweight, high tensile strength, and superior corrosion resistance in automotive hose manufacturing. Manufacturers in the automotive industry are constantly looking to stay competitive by bringing innovative products to market. Safety aspects, excellent performance, and the need for sustainability pressurizes the automotive industry to develop high-quality products. Today, automotive hoses have to perform well despite increasingly difficult conditions. For example, under-hood hose systems must withstand increasingly harsh operating conditions.

Manufacturers are continuously innovating their products. For instance, Dupont provides knitted or braided Kevlar fiber for automobile hoses, which is used to reinforce radiator, gearbox, and turbocharger hoses to make them stronger and lighter. This is because Kevlar is stronger than other materials commonly used in high-pressure hoses and has outstanding thermal stability and chemical resistance. In addition, Teijin offers meta-aramid for extremely high-temperature circumstances on the hot side of the turbocharger for conveying high-temperature gases or fluids or supporting a high-pressure transmission system. Due to all these factors, the automotive segment dominates the aramid fiber market.

Impact of COVID-19 Pandemic on Aramid Fiber Market

Before the COVID-19 pandemic, the aramid fiber market was mainly driven by the increasing use of these fibers in safety & protection equipment, automotive, aerospace, and electronics & telecommunication. However, due to the pandemic, governments of various countries across the globe imposed country-wide lockdowns that directly impacted the growth of the industrial sector. The shutdown of production facilities negatively impacted the market growth in 2020. The disruptions in the supply chain of aramid fiber resulted in increased costs of aramid fiber in different regions. However, with the ease of lockdown measures, various industries regained momentum, which increased the demand for these fibers. Further, many economies began reviving with the resumption of operations in different sectors in 2021. As a result, the market is growing with the rise in demand from various sectors.

Aramid Fiber Market: Competitive Landscape and Key Developments

DuPont de Nemours Inc, Teijin Limited, Yantai Tayho Advanced Materials Company, Hyosung Corporation, Toray Industries Inc, Kolon Industries, Huvis Corporation, China National Bluestar (Group) Co Ltd, Taekwang Industrial Co Ltd, and Kermel SAS are among the players operating in the global aramid fiber market. The market players focus on providing high-quality products to fulfill customer demand.

Key Developments

- In April 2023, DuPont de Nemours Inc. announced the launch of Kevlar EXOTM aramid fiber. Kevlar EXO will provide a combination of lightness, flexibility, and protection from aramid fiber, with life protection as the first of many use cases.

- In September 2022, Mussel Polymers, Inc., a specialty materials and coatings company, announced that it had successfully coated carbon and aramid fibers with its Poly(catechol-styrene) (PCS), which is a step forward in producing lighter, stronger fiber-reinforced composites.

- In June 2021, Kolon Industries Inc., South Korea’s textile and chemical materials maker, announced an investment of US$ 212 million (240 billion won) to double the capacity of its domestic aramid fiber factory. The company has planned to increase production capacity from 7,500 metric ton to 15,000 metric ton by 2023.