Anti-Counterfeit Packaging Market

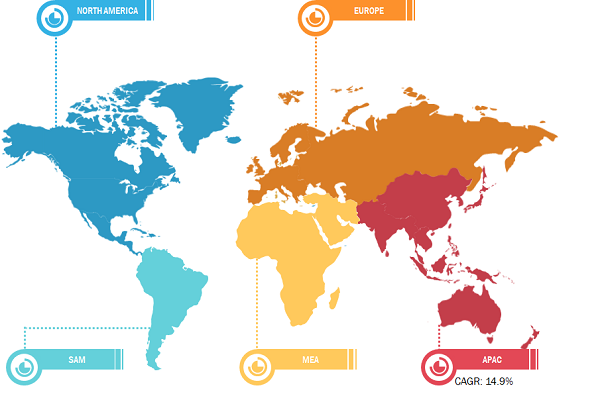

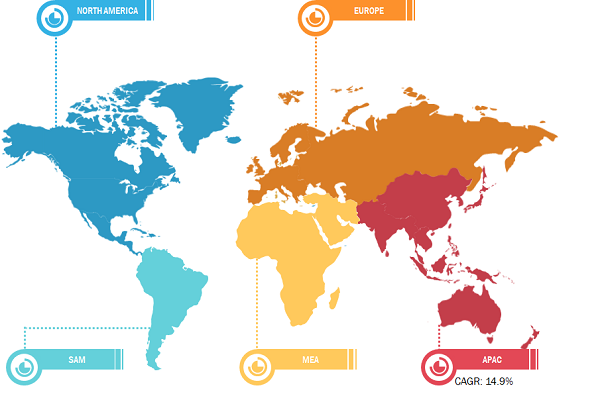

In 2022, North America held the largest share of the global anti-counterfeit packaging market. The major factors driving the growth of the anti-counterfeit packaging market in North America are the increasing cases of counterfeiting and stringent regulations associated with anti-counterfeit packaging. Thus, the US government imposed Drug Supply Chain Security Act (DSCSA) in 2013 to control counterfeit product sales in the country. According to the US Drug Enforcement Administration (DEA), in September 2022, the number of seized fentanyl-tainted counterfeit pills recorded a growth of 430% in 2022 compared to 2019.

Growing Demand from Pharmaceutical Industry Boosts Anti-Counterfeit Packaging Market

Counterfeit pharmaceutical products are fake or unauthorized replicas of genuine medications intentionally mislabeled, adulterated, or substandard in quality. Counterfeit pharmaceutical products pose significant risks to public health and safety, leading to a growing concern among regulatory bodies, pharmaceutical companies, and consumers. The pharmaceutical industry is particularly vulnerable to counterfeiting due to the high value and demand for medications, complex global supply chains, and the potential for substantial financial gain for counterfeiters. According to Interpol, the global trade in illicit pharmaceuticals is a substantial crime area, which is valued at US$ 4.4 billion, as it attracts the involvement of organized crime groups worldwide.

Anti-Counterfeit Packaging Market: Segmental Overview

Based on technology, the anti-counterfeit packaging market is segmented into security inks and coatings, Radio Frequency Identification (RFID), forensic markers, tamper evident, holograms, barcode, and others. The plastic segment held the largest share in 2022. Barcode is the most preferred type of anti-counterfeit packaging for most of the products. Barcodes are widely used in anti-counterfeit packaging as a simple yet effective method to enhance security and enable product authentication. A barcode is a graphical representation of data that consists of a series of parallel lines and spaces of varying widths. Barcodes are scanned and interpreted by barcode readers or scanning devices such as scanners or mobile devices with scanning capabilities. A barcode serves as a unique identifier that can be cross-referred with a database to verify the authenticity of the product. Barcodes enable the tracking and tracing of products throughout the supply chain. The increase in the adoption of barcodes in a large number of products is expected to further boost the anti-counterfeit packaging market growth.

Based on application, the anti-counterfeit packaging market is segmented into food and beverage, pharmaceutical, personal care and cosmetics, electrical and electronics, textile and apparel, automotive, and others. The anti-counterfeit packaging market share for the pharmaceutical segment was the largest in 2022. The pharmaceutical industry is particularly vulnerable to counterfeiting due to potential risks to patient health and fitness. Counterfeit pharmaceuticals can contain incorrect or ineffective ingredients or harmful substances and display incorrect dosages. Each package or unit of medication is assigned a unique identification code or serial number. This can be in the form of a barcode, QR code, or alphanumeric code. Thus, the increased adoption of anti-counterfeit solutions in the pharmaceutical industry is expected to boost the anti-counterfeit packaging market growth during the forecast period.

Impact of COVID-19 Pandemic on Anti-Counterfeit Packaging Market

Anti-counterfeit packaging refers to measures taken to prevent the imitation or unauthorized replication of products. The COVID-19 pandemic has led to an increased demand for certain products, such as pharmaceuticals, healthcare supplies, and essential consumer goods. This surge in demand raised concerns about counterfeit products flooding the market, posing risks to public health and safety. As a result, the need for effective anti-counterfeit packaging solutions increased rapidly. The pandemic has highlighted the importance of traceability, authentication, and tamper-evident features in packaging to ensure product integrity and consumer trust. Consequently, the anti-counterfeit packaging market has experienced growth and innovation, with companies investing in holograms, QR codes, barcodes, serialization, and other technologies to enhance product security and supply chain transparency.

Anti-Counterfeit Packaging Market: Competition Landscape

Arjo AB, Octane5 International LLC, Antares Vision SpA, CCL Industries Inc, Avery Dennison Corp, The Label Printers LP, KURZ Transfer Products LP, Gestion Groupe Optel Inc, Brady Corp, and Constantia Flexibles International GmbH are among the key players operating in the global anti-counterfeit packaging market. These players focus on providing high-quality products to fulfill customer demand. They also focus on strategies such as investments in research and development activities and new product launches.