Fluoroelastomers Market

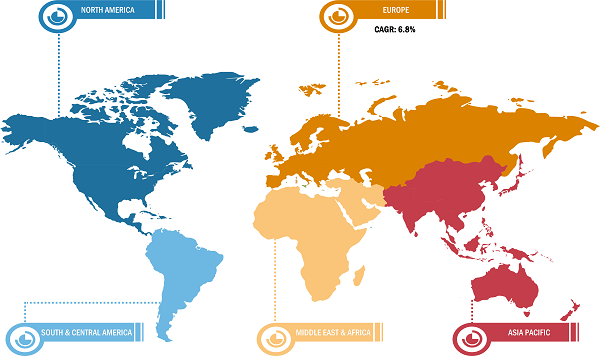

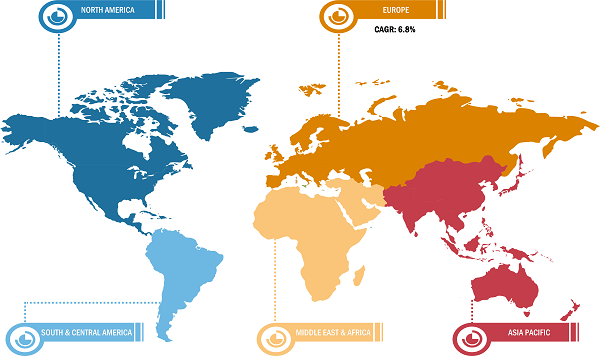

In 2022, Asia Pacific dominated the global fluoroelastomers market. The market growth in Asia Pacific is driven by the strong presence of the automotive industry. The demand for fluoroelastomers in Asia Pacific is in parallel with industrialization and vehicular production in the region. The increase in the number of on-fleet vehicles in countries such as China, India, and South Korea is propelling the demand for PCBs and semiconductors, further bolstering the need for fluoroelastomers. With China’s evolution into a high-skilled manufacturing hub, developing countries such as India, South Korea, Taiwan, and Vietnam are attracting several businesses that plan to relocate their low to medium-skilled manufacturing facilities to neighboring countries, which results in reduced labor costs. As per the study by the Semiconductor Industry Association, 75% of global semiconductor capacity is based in East Asia. Semiconductor companies will benefit from a cost advantage of 25–50% with the start of manufacturing activities in the region. According to the 2022 report by the International Energy Agency, in 2021, 3.3 million electric vehicles were sold in China. Thus, the growing automotive and semiconductor industry in Asia Pacific is expected to create lucrative business opportunities for the fluoroelastomers market players in the region during the forecast period.

Rising Demand for Fluoroelastomers in Automotive Industry

Fluoroelastomers are used in a wide range of applications in the automotive industry. It is used in fuel system components, seals, gaskets, and hoses due to its high resistance to heat, chemicals, and fuels. According to the report by the European Commission, turnover generated by the automotive industry in Europe represents 7% of the region’s total GDP. A report by Germany Trade & Invest stated that Germany is a major automotive market in Europe, and it registered a foreign market revenue of US$ 289 billion in 2021 (a 10% rise from 2020) from passenger car and light commercial vehicle original equipment manufacturers. According to the report released by the European Automobile Manufacturers’ Association (ACEA) in January 2023, car production in North America increased by 10.3%, reaching 10.4 million units in 2022 compared to 2021. Similarly, passenger car production in South Korea rose by 7.6%, reaching 3.4 million units in 2022 compared to 2021.

According to a report published by the ACEA, global passenger car production accounted for 68 million units in 2022, a rise of 7.9% compared to 2021. As per the International Organization of Motor Vehicle Manufacturers, in 2022, motor vehicle production in Japan reached 7.83 million units. With the rise in the production of vehicles, the need for fluoroelastomers also increased. Thus, the rising demand for high-performance materials in the automotive industry drives the fluoroelastomers market.

Fluoroelastomers Market: Segmental Overview

Based on type, the fluoroelastomers market is segmented into fluorocarbon elastomers, fluorosilicone elastomers, and perfluorocarbon elastomers. The fluorocarbon elastomers segment held the largest market share in 2022, and the perfluorocarbon elastomers segment is expected to record the highest CAGR from 2022 to 2030. Fluorocarbon elastomers have exceptional resistance to high temperatures, aggressive chemicals, and a wide range of fluids, which makes them a preferred choice in industries such as aerospace, automotive, and chemical processing. Perfluorocarbon elastomers are composed of fully fluorinated carbon atoms, making them nearly impervious to attack by almost all known chemicals, even at elevated temperatures.

Based on application, the fluoroelastomers market is segmented into O-rings, seals and gaskets, hoses, molded parts, and others. The O-rings segment held the largest fluoroelastomers market share in 2022. Fluoroelastomer O-rings exhibit excellent resistance to high temperatures, chemicals, and fuels. They can effectively create a tight, durable seal in demanding environments. In the automotive industry, fluoroelastomer O-rings are used in engine components, fuel systems, and transmission systems.

Based on end-user, the fluoroelastomers market is segmented into automotive, aerospace, oil and gas, semiconductors, energy and power, and others. The automotive segment held the largest fluoroelastomers market share in 2022. Fluoroelastomers are indispensable in the automotive industry, serving many critical functions such as acting as a sealant in fuel systems, cooling systems, and intake and exhaust systems. The elastomers are used in components such as O-rings, gaskets, and seals that endure extreme conditions in engines, transmissions, and fuel systems. Fluoroelastomer seals and gaskets ensure reliable, long-lasting seal in-vehicle systems, reducing the risk of leaks and enhancing overall safety.

Impact of COVID-19 Pandemic on Fluoroelastomers Market

Before the COVID-19 pandemic, many countries reported economic growth, whereas fluoroastomers manufacturers invested in research to develop advanced technology and improve production efficiency. Major market players also focused on geographic expansion through merger and acquisition strategies to cater to a broad customer base. For instance, in 2018, Solvay SA increased fluoroelastomer production capacity at its manufacturing sites in China and Italy to cater to high demand from the automotive industry.

The chemicals & materials industry announced a slowdown of manufacturing operations and shutdown, as well as projected a slump in fluoroelastomers sales. Thus, major companies involved in fluoroelastomer production faced the hardest hit during the initial phase of the pandemic due to sudden government restrictions on the manufacturing of nonessential commodities. In 2021, several automotive companies began recovering from the losses incurred in 2020 with the revival of production operations. Manufacturers were permitted to operate at full capacities, which helped them cope with the demand-supply gap. With economies reviving their operations, the demand for fluoroelastomers started rising globally as the automotive industry resumed its operations at full capacity.

Fluoroelastomers Market: Competitive Landscape and Key Developments

The Chemours Co, AGC Inc, 3M Company, Solvay SA, Daikin Industries Ltd, Shandong Huaxia Shenzhou New Material Co Ltd, Gujarat Fluorochemicals Ltd, Shin-Etsu Chemical Co Ltd, HaloPolymer, and Eagle Elastomer Inc are a few players operating in the global fluoroelastomers market. Players operating in the global fluoroelastomers market focus on providing high-quality products to fulfill customer demand.

Key Developments

- In September 2023, AGC Chemicals Americas Inc added two new grades to its line of perfluoroelastomers. AFLAS FFKM PM-5000 and FFKM PM-5500 perfluorinated elastomers can be used for semiconductor plasma process applications due to their high-temperature durability beyond 300°C and excellent resistance to O2 and NF3 plasma.

- In June 2022, Solvay SA introduced a new portfolio of high-performance Tecnoflon peroxide curable fluoroelastomers (FKM) produced without the use of fluorosurfactants.