Aerial Refueling Market

The changing modern warfare scenario has obligated governments of various countries to allocate significant funds and financial aid to respective defense and military forces. The defense budget allocation supports army and military forces in purchasing technologies and equipment from domestic or international developers. There is an augmented need to reinforce defense and military forces with advanced airborne defense systems; hence, air forces across the globe are focusing on investing significant amounts in procuring advanced technologies. Defense forces’ constant inclination to acquire new technologies for noncombat and combat operations further boosts military expenditure worldwide.

As per the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased to US$ 2,148 billion in 2022, representing a 3.5% increase from 2021. The US, China, India, Russia, and Saudi Arabia were the top five spenders in 2022, which accounted for 63% of the global expenditure. The figure given below depicts the yearly spending of these countries.

| Country | 2020 (US$ Million) | 2021 (US$ Million) | 2022 (US$ Million) |

| US | 778,397.2 | 800,672.2 | 876,943.2 |

| China | 257,973.4 | 293,351.9 | 291,958.4 |

| Russia | 61,712.5 | 65,907.7 | 86,373.1 |

| India | 72,937.1 | 76,598.0 | 81,363.2 |

| Saudi Arabia | 64,558.4 | 55,564.3 | 75,013.3 |

Source: SIPRI

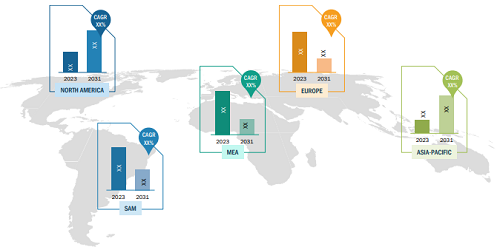

North America was estimated to be the largest region in terms of market share in the global aerial refueling market in 2022; it is also expected to retain its dominance during the forecast period. This is mainly due to the presence of aerial refueling system manufacturers across North America such as Eaton, GE Aviation, Marshall Aerospace & Defense Group, Parker Hannifin Corporation, Boeing, Raytheon Technologies, etc. Such companies are constantly working with different armed forces to understand their respective requirements related to aerial refueling systems and provide them with reliable solutions to remain competitive in the highly consolidated market. Moreover, another major factor driving the growth of the aerial refueling market includes the presence of the largest combat aircraft, tanker aircraft, helicopters, and military UAV fleet that constantly generates the demand for air-to-air refueling systems across the region. Furthermore, the companies operating in the North America aerial refueling market serve other regions and generate new revenues, which contributes to the aerial refueling market growth in the region.

Rising Procurement of Military Aircraft to Provide Lucrative Opportunities for Aerial Refueling Market During Forecast Period

- In October 2023, Airbus Defense and Space won a contract worth US$ 1,296.02 million to provide capability enhancement and in-service support for the French A330 MRTTs (Multi Role Tanker Transport) fleet of the French military.

- In November 2023, Lockheed Martin secured a contract worth US$ 177 million to upgrade Chilean F-16 fighter jets.

- In April 2023, Lockheed Martin Corporation won a contract worth US$ 7.8 billion from the US Pentagon to upgrade 126 units of F-35 multi role military aircraft.

- In July 2023, Boeing announced that it had secured a contract worth US$ 795 million to provide military aircraft to the US Army.

- In September 2021, Tata and Airbus collaborated and signed a contract worth US$ 2,736.32 million to manufacture military aircraft in India.

Such procurement and refurbishment (upgrades) of military aircraft are expected to create new opportunities for aerial refueling market players across different regions during the forecast period.

Aerial Refueling Market: Segmental Overview

The “aerial refueling market analysis” has been carried out by considering the following segments: component, aircraft type, system type, end use, and geography. In terms of component, the aerial refueling market is categorized into refueling pods, refueling probes, drogues, hoses, boom, and others. The boom segment accounted for the largest aerial refueling market share in 2022, and it is expected to retain its dominance during the forecast period. Based on aircraft type, the aerial refueling market is segmented into tanker & combat aircraft, helicopter, and UAVs. In 2022, the tanker & combat aircraft segment accounted for the largest share of the global aerial refueling market, and it is expected to retain its dominance during the forecast period. Based on system type, the aerial refueling market is bifurcated into probe & drogue and boom & receptacle. In 2022, the probe & drogue segment accounted for a larger share in the global aerial refueling market, and it is expected to retain its dominance during the forecast period as well. Based on end use, the aerial refueling market is divided into OEMs and aftermarket. In 2022, the OEMs segment accounted for a larger share of the global aerial refueling market, and it is expected to continue dominating during the forecast period. The scope of the aerial refueling market report includes North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In addition, in 2022, North America accounted for the largest share of the global aerial refueling market; however, Asia Pacific is likely to register the highest CAGR during the forecast period.

Aerial Refueling Market Analysis: Competitive Landscape and Key Developments

Cobham Plc, Safran, Eaton, GE Aviation, Marshall Aerospace & Defense Group, Parker Hannifin Corporation, Israel Aerospace Industries Ltd, BAE Systems Plc, Elbit Systems Ltd, and ARESIA are a few of the major aerial refueling market players across different regions. The market leaders focus on new contracts, product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

- In November 2023, the US Air Force awarded a contract worth US$ 2.3 billion to Boeing for the supply of 15 units of KC-46 refueling tanker aircraft.

- In September 2022, the Israeli Air Force awarded a contract worth ~US$ 1 billion to Boeing for supplying them with 4 new KC-46 Pegasus refueling tankers, which are expected to be delivered by the end of 2026.